Welcome to the inaugural edition of The BRG Market Report.

If you’ve been paying attention to commercial real estate trends over the past few years, you’ve likely noticed a significant shift in where capital is flowing. Investors who once focused exclusively on coastal gateway markets are now turning their attention southward: and for good reason.

The Southeast isn’t just having a moment. It’s experiencing a fundamental transformation that’s reshaping the commercial real estate landscape for decades to come.

At Buchanan Realty Group, we’ve had a front-row seat to this evolution. As a boutique commercial real estate firm rooted in Tennessee, we’ve watched our region transition from “secondary market” status to one of the most compelling investment destinations in the country.

Let’s break down exactly why the Southeast has become the new frontier for CRE investors: and what that means for your portfolio.

The Great Migration: Population and Business Relocation

The numbers don’t lie. The Southeast continues to lead the nation in both population growth and business relocations. Tennessee alone has seen consistent inbound migration from higher-tax states like California, New York, and Illinois.

But this isn’t just about people moving for lower taxes and better weather (though those certainly help). It’s about companies relocating their operations, expanding their footprints, and establishing new facilities in markets that offer:

- Business-friendly regulatory environments

- Lower operating costs

- Access to skilled labor pools

- Strategic logistics positioning

When major corporations move, they bring jobs. When jobs arrive, housing follows. When housing develops, retail and hospitality demand surges. It’s a virtuous cycle that’s been playing out across Tennessee, Georgia, the Carolinas, and Florida for years: and it’s showing no signs of slowing down.

Retail: The Sector That Refused to Die

Remember when everyone declared retail dead? The Southeast didn’t get that memo.

While e-commerce continues to reshape consumer behavior, physical retail in growing Southeast markets tells a different story. The key differentiator? Population density and purchasing power are increasing simultaneously.

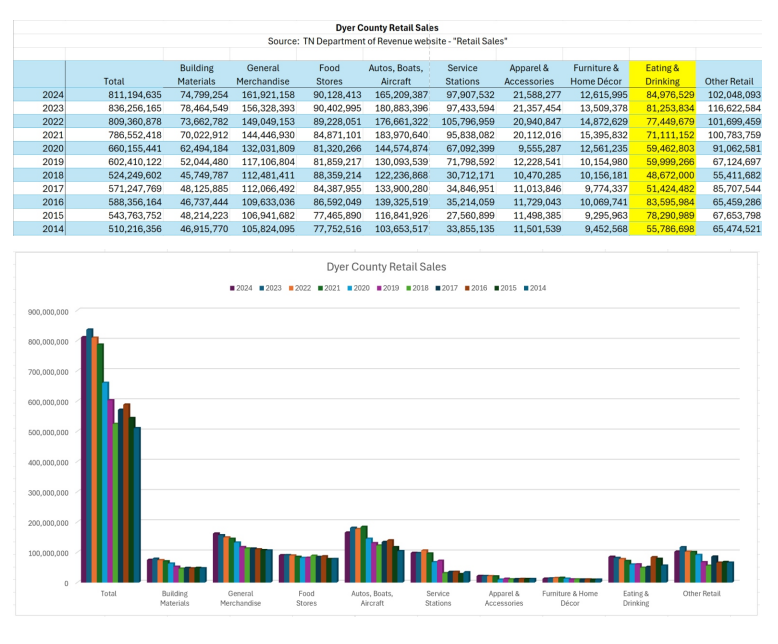

Take a look at the data we’ve been tracking in markets like Dyer County, Tennessee:

Total retail sales reached $811 million in 2024, with consistent year-over-year growth across virtually every sector. Eating and drinking establishments generated $84.9 million, general merchandise hit $161.9 million, and building materials came in at $74.8 million.

These aren’t numbers from a dying sector. They’re indicators of a thriving local economy with room to grow.

For investors, this translates to opportunities in:

- Neighborhood retail centers anchored by essential services

- Quick-service restaurant outparcels in high-traffic corridors

- Mixed-use developments combining retail with residential density

The sweet spot? Markets with strong population growth but limited new retail construction. Supply constraints plus demand growth equals rent appreciation.

Hospitality: Riding the Experience Economy

The hospitality sector in the Southeast has proven remarkably resilient. While business travel patterns have shifted post-pandemic, leisure travel and regional tourism have more than picked up the slack.

Tennessee, in particular, benefits from multiple tourism drivers:

- Nashville’s continued dominance as a destination city

- Outdoor recreation drawing visitors to state parks and natural attractions

- Event-driven travel from concerts, sports, and conferences

But here’s what many investors miss: the real hospitality opportunity isn’t always in the obvious markets. Secondary and tertiary cities along major interstate corridors are seeing increased demand for select-service hotels, extended-stay properties, and boutique accommodations.

These markets often offer better cap rates, lower barriers to entry, and less competition from institutional capital. For the right investor, that’s a compelling combination.

Industrial: The Backbone of Southeast Growth

If retail surprised the skeptics and hospitality showed resilience, industrial has been the undisputed star of Southeast CRE.

The region’s strategic position makes it ideal for distribution and logistics operations. Memphis remains a global logistics hub, but the ripple effects extend throughout Tennessee and neighboring states. Companies need warehouse space, last-mile delivery facilities, and manufacturing sites: and they need them yesterday.

What’s driving industrial demand in the Southeast?

- E-commerce fulfillment requirements pushing closer to population centers

- Reshoring initiatives bringing manufacturing back to domestic facilities

- Supply chain diversification reducing reliance on single-point logistics

- Infrastructure investments improving transportation connectivity

For investors focused on industrial assets, the Southeast offers a rare combination: strong tenant demand, reasonable land costs, and development-friendly municipalities eager to attract employment.

Our Approach: Boutique Service, Institutional Insight

Here’s where we get a little personal.

Buchanan Realty Group isn’t a massive national firm with offices in every city. We’re a boutique commercial real estate company with deep roots in the Southeast: and we think that’s an advantage.

Our team brings expertise across investment sales, development, and property management. We’re not generalists trying to be everything to everyone. We’re specialists who understand the nuances of Southeast markets because we live and work here every day.

What does that mean for our clients?

- Local market intelligence that national firms simply can’t replicate

- Relationship-driven deal flow built over years of regional presence

- Personalized service where you work directly with experienced professionals

- Aligned interests because our reputation depends on your success

Whether you’re looking to acquire your first commercial property, expand an existing portfolio, or explore development opportunities, we bring institutional-quality insight with boutique-level attention.

What We’re Watching in 2026

As we look ahead, several trends are shaping our investment thesis for the Southeast:

Interest Rate Stabilization

After years of uncertainty, capital markets are finding their footing. This is unlocking transactions that were previously sidelined and bringing buyers and sellers closer to agreement on pricing.

Suburban Office Repositioning

While urban office continues to face headwinds, well-located suburban office assets are attracting attention: particularly those with potential for conversion or repositioning.

Healthcare-Adjacent Real Estate

Medical office buildings and healthcare-adjacent retail continue to perform well, driven by demographic trends and the ongoing expansion of healthcare systems throughout the region.

Opportunity Zone Investments

Several Southeast markets still offer compelling Opportunity Zone plays, providing tax advantages alongside genuine appreciation potential.

The Bottom Line

The Southeast has earned its reputation as the new frontier for commercial real estate investment. Population growth, business-friendly policies, diversified economic drivers, and relative affordability compared to coastal markets create a compelling case for capital allocation.

But not every deal is a good deal, and not every market within the region offers equal opportunity. Success requires local expertise, disciplined underwriting, and partners who understand the terrain.

That’s exactly what we deliver at Buchanan Realty Group.

This is the first edition of The BRG Market Report, but it won’t be the last. We’ll be bringing you regular insights on Southeast CRE trends, specific market analyses, and investment perspectives designed to help you make informed decisions.

Have questions about a specific market or property type? Want to discuss investment opportunities in Tennessee and the broader Southeast? Reach out to our team: we’d love to hear from you.

Until next time, stay sharp out there.

The BRG Market Brief is published by Buchanan Realty Group, a boutique commercial real estate firm specializing in investment sales, development, and property management across the Southeast. Explore our current listings or learn more about our team.